Tax court allows bonus depreciation solar energy credit to taxpayer tax alert june 07 2018 on june 5 2018 the united states tax court ruled in favor of the petitioner taxpayer in claiming the solar energy credit under sections 46 and 48 and macrs bonus depreciation under section 168 k 5.

Bonus depreciation on solar panels.

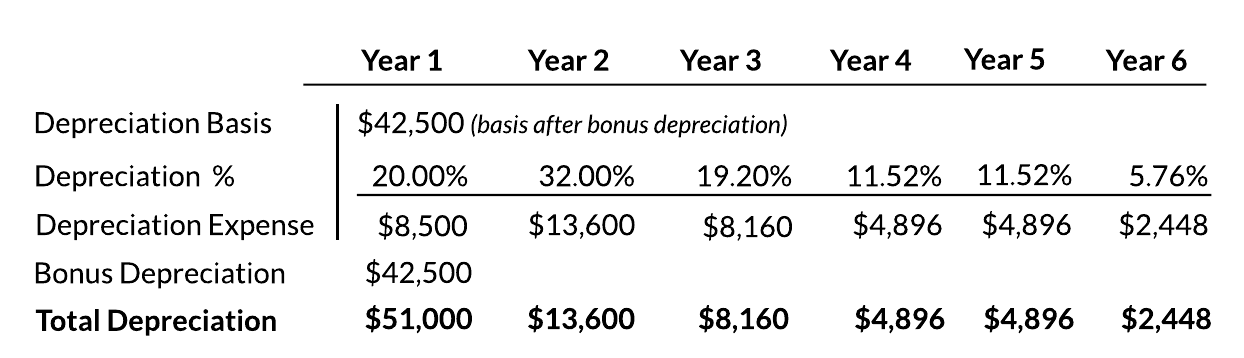

Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows.

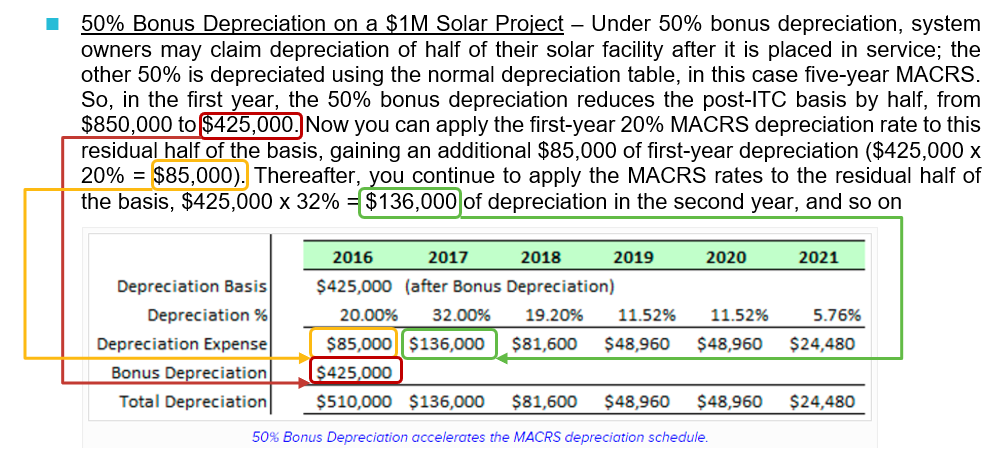

Under 50 bonus depreciation system owners may claim depreciation of half of their solar facility after it is placed in service.

Macrs depreciation of solar panels.

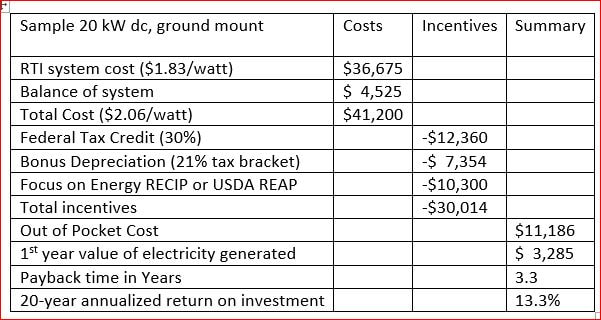

Depreciation on solar panels is one of the easiest ways businesses and farms looking to go solar can keep installation costs down rois high and paybacks short.

Bonus depreciation under sec.

The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated with integrating solar energy.

Year 1 20 year 2 32 year 3 19 2 year 4 11 5 year 5 11 5 and year 6 5 8.

For 2011 the special allowance was 100 of the adjusted basis of certain qualified property.

168 k 1 a the depreciation deduction provided by sec.